WHY START A BUSINESS HERE?

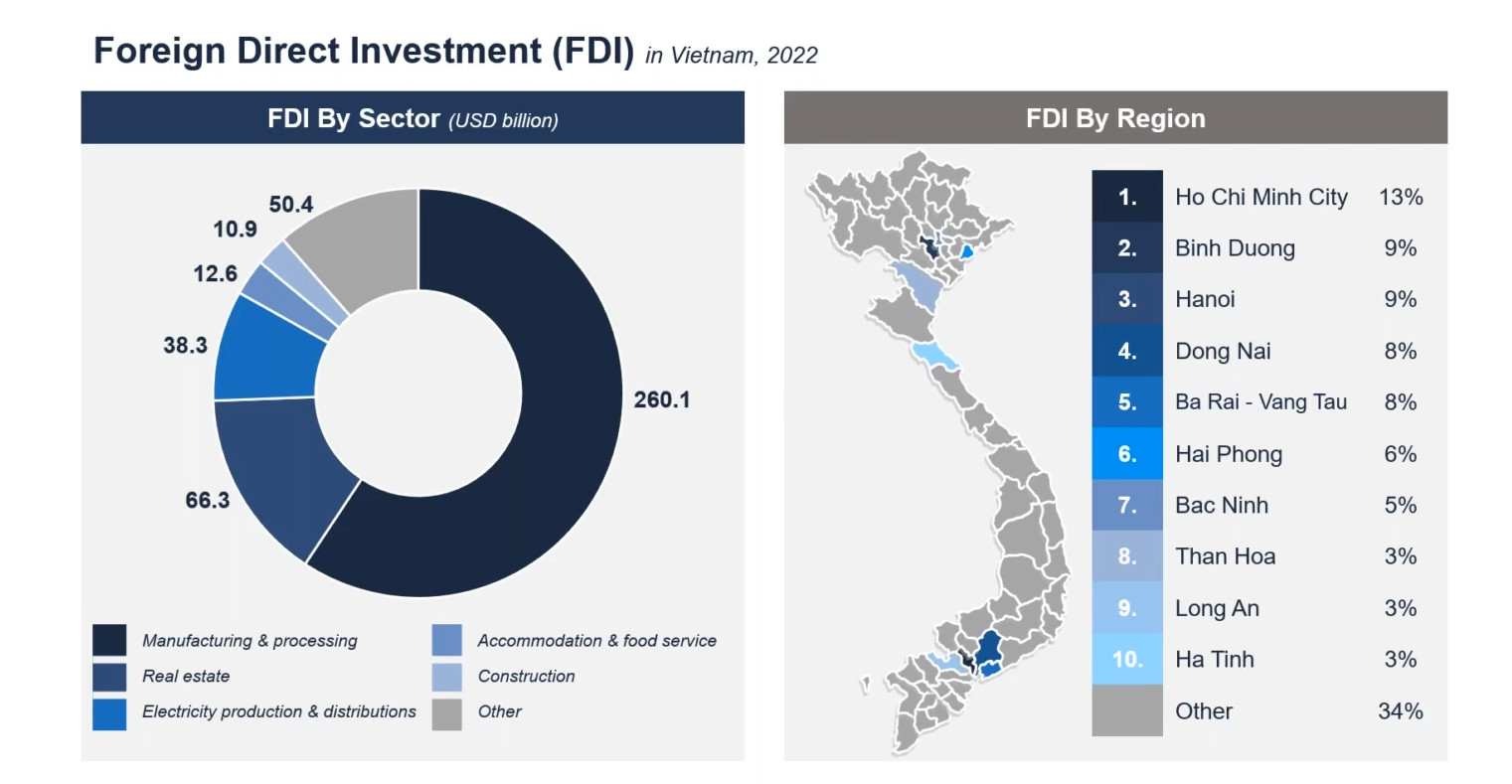

- Vietnam has a strategic location, located in the center of ASEAN. Vietnam is the third largest market in Southeast Asia and one of the fastest growing economies in the world. Vietnam owns a long sea route, is the trading gateway of countries, convenient for transactions

- Stable political foundation, complete legal system

- Vietnam has policies to attract foreign direct investment (FDI). Incentives on tax rates and CIT of a number of investment sectors and fields are very attractive to investors.

- Member of many trade organizations. The most dynamic emerging economy

- Knowledgeable and skilled workforce

![]()

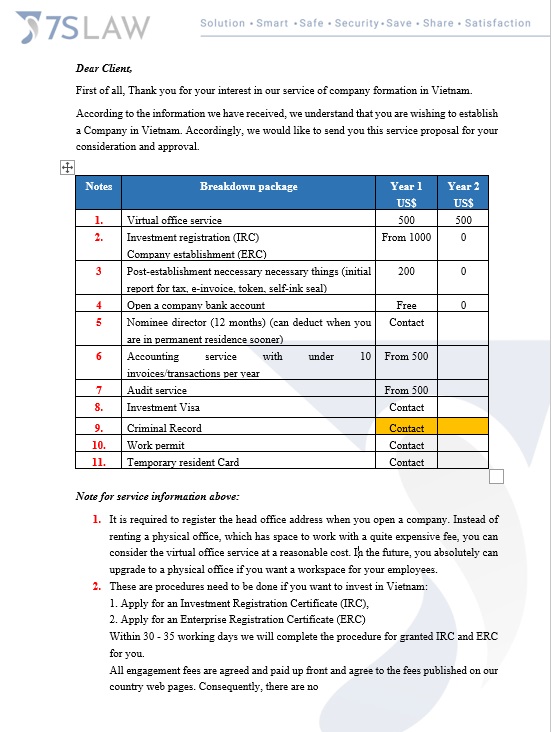

FEES AND TIMELINES?

Except in some instances take longer time we’ll well-note with you in advance | Start from $1,199 in general. |

LEGAL, ACCOUNTING & TAX

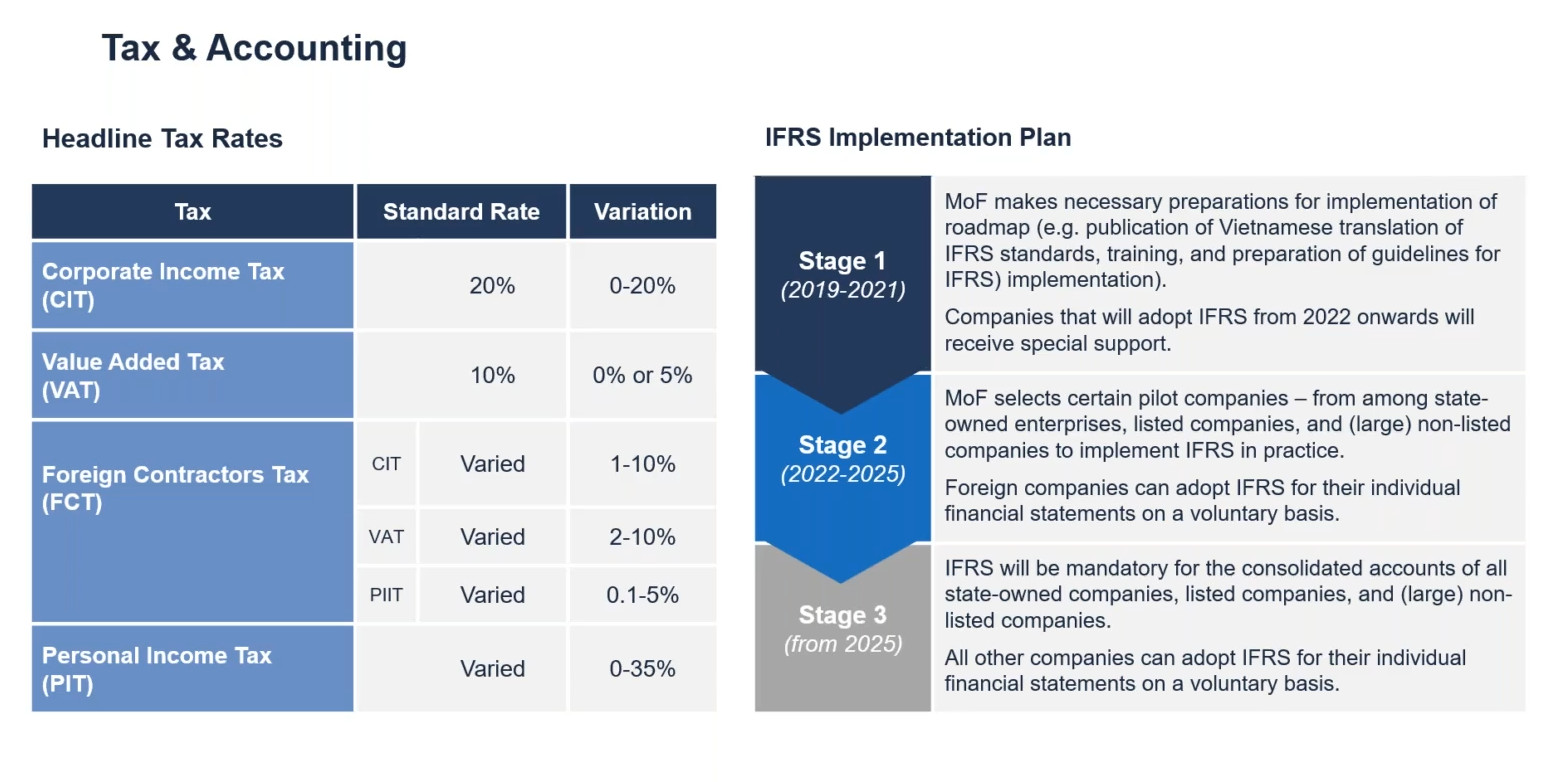

- The standard foreign corporate income tax rate in Vietnam is 20%. Enterprises make quarterly reports on personal income tax, corporate income tax and value added tax. Dividends paid to corporate shareholders will be completely tax-free

- Personal income tax for residents is levied under a progressive system, ranging from 5% to 35%. However, for non-resident individuals (foreigners), the tax is levied at 20%.

- The annual corporate income tax report must be submitted to the General Department of Taxation within 90 days from the end of the fiscal year. Documents must be written in Vietnamese. A Vietnam-based auditing firm must audit the annual financial statements of foreign businesses.

- 7SLAW supports you in all aspects of tax and financial reporting compliance for your company in Vietnam.

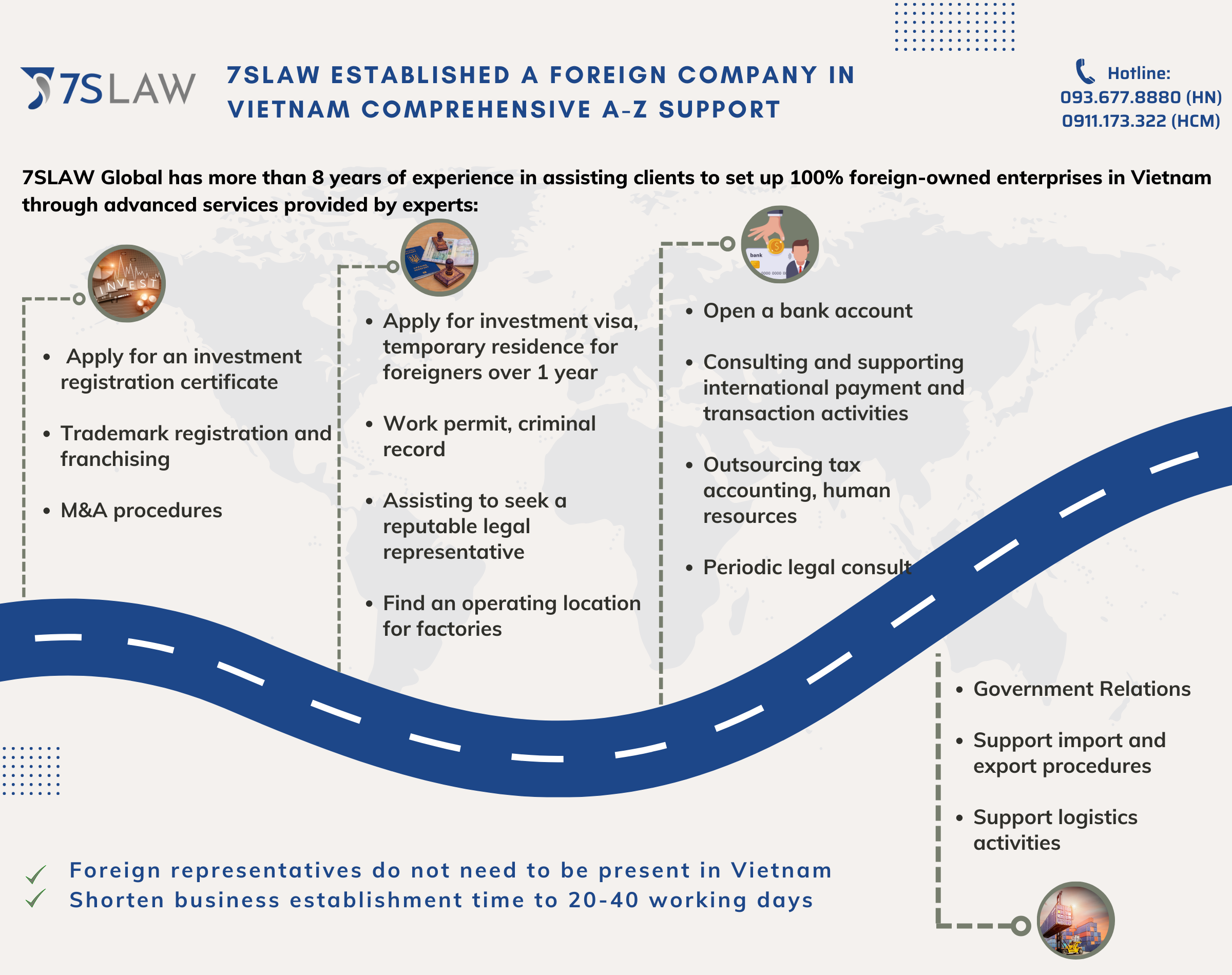

BUSSINESS SETUP SUPPORT SERVICESRELATED POSTS

+ Employment and residence visas?

In order to enter Vietnam, a foreigner needs a visa issued by the Vietnamese Embassy or Consulate. Foreign investors who are listed in the Investment Registration Certificate will be considered for a temporary residence card with a term of 1-5 years.

+ Trademark registration

Registering for trademark protection helps customers protect their assets, increase brand recognition, market share and competitive advantage. 7SLAW is reputable and professional, with long-term experience in the field of intellectual property, providing antitrust guidance for competitive transactions and disputes. Responding to the intellectual property needs of our customers worldwide, we are able to register trademarks in Asia, the United States, and Singapore.

+ Find office premises:

If you do not have an address to register your company, 7S Law will provide you with a legal address at a competitive price. In addition, you can use any convenient office services in Hanoi, Ho Chi Minh and other localities.

FAQ

- What is the process for setting up a company?

Step 1: Investment Registration Certificate(within 30 days)

Step 2: Enterprise Registration Certificate(within the next 07 days)

Step 3: Self-ink stamp, Electronic digital signature, E-invoice, Company sign (within the next 02 day)

Except in some instances take longer time we’ll well-note with you in advance

- What are the IRC & ERC?

IRC stands for Investment Registration Certificate which shall be obtained (in most cases) when a foreign investor wants to set up a project (such as establishing a company) in Vietnam at the beginning.

ERC stands for the Enterprise Registration Certificate which every company in Vietnam must have. In other jurisdiction it is sometimes referred to as the “Incorporation Certificate” or “Company Certificate”.

- What do I need to prepare to set up a company in Vietnam?

- Passport of Investors, notarized at the Vietnamese Embassy

- ID/ Passport of Legal Representative of the company notarized in Vietnam or legalized at Viet Embassy in your country

- Bank statements/Proof of funds showing sufficient charter capital

- Proof of company address (Office Lease Agreement in Vietnam)

Furthermore, you need to send us details on a business plan company's objectives, market analysis, marketing strategies, financial projections, etc. director and shareholders, capital amount, company names, business sector

- What is the time required for establishing a company in Vietnam?

For non-conditional business sectors, we usually need from 30 to 35 working days to setup a foreign-invested company.

Providing us with the necessary information and documents at the earliest would expedite the company formation process in Vietnam.

However, especially for foreign-owned companies, the time can be extended due to various reasons such as additional requirements from the licensing authorities.

- Is it necessary to have a business address in Vietnam? Can I use a virtual address to register a company in Vietnam?

It is required to register the head office address when you open a company. Instead of renting a physical office, which has space to work with a quite expensive fee, you can consider the virtual office service at a reasonable cost. In the future, you absolutely can upgrade to a physical office if you require a workspace for your employees

- What is the minimum investment capital required for establishing a company in Vietnam?

By law, there is no minimum investment capital required when registering a company in Vietnam, except for some conditional business sectors that requires a specific capital such as banking or education.

Nonetheless, the investment capital must be appropriate for the intended business scope and scale of operation. We will advise you about the minimum capital on unique situation

- What type of company is usually chosen?

In Vietnam, the most common types of companies are limited liability companies (LLCs), joint-stock companies (JSCs), and partnerships. Limited liability companies are the most popular type of company for small and medium-sized businesses due to their simplicity, flexibility, and low capital requirements.

It is crucial to choose the right type of company to suit the business's needs, goals, and long-term plans. Consulting with a legal expert or a business consultant can help in making this decision.

- What is a Limited Liability Company in Vietnam?

In Vietnam, LLCs are a popular choice for both domestic and foreign investors, who can be of any nationality and does not need to be resident in Vietnam. A Limited Liability Company (LLC) in Vietnam is a type of business entity that is owned by one or more individuals or legal entities up to 50 members. In an LLC, the liability of the owners (referred to as members) is limited to the amount of capital that they have contributed to the company. This means that the members are not personally responsible for the company's debts and obligations.

Foreign companies wishing to have full control when establishing a company in Vietnam may find the single-member limited liability company structure particularly useful.

- What is a Joint-Stock Company in Vietnam?

A Joint-Stock Company (JSC) can be setup with 3 or more shareholders and there is no limit on the number of shareholders, who can be of any nationality and does not need to be resident in Vietnam. It is a form of corporate organization where the capital of the company is divided into shares, with each shareholder holding a specific number of shares proportional to their investment in the company. Unlike a Limited Liability Company (LLC), a JSC can issue shares to the public and is subject to more stringent regulations by the government.

- Do I need to make a trip to Vietnam in order to register a company in Vietnam?

No, you do not necessarily have to visit Vietnam to incorporate a Vietnam company. The incorporation process can be handled through authorized representatives or lawyers, provided that all required documents and information are submitted accurately and completely.

- In order to complete incorporation, is it compulsory to open a bank account in Vietnam?

Yes, it is generally compulsory to open a capital account at a local bank in Vietnam This is because you will need to deposit the minimum required capital for your company and necessary for the transfer of future profits overseas.

- What if I set up company in free zone?

Foreigners who intend to manufacture and export a significant portion of their products may opt to register a company in a Vietnam free zone. The company must undergo review and approval by the relevant authority before being registered within an industrial park or special economic zone.

The criteria for free zone registration vary significantly depending on the project, but typically require a minimum investment and the creation of some jobs in Vietnam. Projects eligible for free zone registration are generally granted tax benefits.

- What taxes do companies in Vietnam have to pay?

Companies in Vietnam are subject to various taxes, including:

Corporate Income Tax (CIT): This tax is levied on the profits of companies operating in Vietnam. The current CIT rate is 20% for most businesses, but some industries may have a lower rate.

Value Added Tax (VAT): VAT is a tax on the value added to a product or service at each stage of production and distribution. The current VAT rate is 10%, but some goods and services may be subject to a lower or higher rate.

Personal Income Tax (PIT): PIT is levied on the income of individuals working in Vietnam, including employees of companies. The PIT rate for residents is levied under a progressive system, ranging from 5% to 35%. However, for non-resident individuals (foreigners), the tax is levied at 20%.

Special Consumption Tax (SCT): SCT is a tax on the consumption of certain goods, such as tobacco, alcohol, and automobiles. The SCT rate varies depending on the type of goods.

Import and Export Duties: Companies importing or exporting goods to/from Vietnam are subject to import and export duties, which vary depending on the type of goods and their value.

Environmental Protection Tax (EPT): EPT is a tax on the consumption or use of certain products that have a negative impact on the environment, such as plastic bags and motor vehicles. The EPT rate varies depending on the type of product.

Land Rental Fee: Companies that lease land from the government are subject to a land rental fee, which varies depending on the location and value of the land.

It's important to note that the tax laws in Vietnam are subject to change, so it's important for companies to stay up-to-date on their tax obligations.

- What is the deadline for submitting quarterly tax returns and compiled financial statements in Vietnam for a fiscal year?

Quarterly tax returns must be prepared and filed within 30 days after the end of the corresponding quarter, while an audited annual financial statement must be prepared and filed within 90 days after the end of the relevant fiscal year. Documents must be written in Vietnamese. A Vietnam-based auditing firm must audit the annual financial statements of foreign businesses.

- What is the Fiscal Year in Vietnam?

The fiscal year is defined as the accounting period of the company, which can be up to 12 months. There are four options for the fiscal year period that companies can choose from in Vietnam:

January 1 to December 31

April 1 to March 31

June 1 to May 31

October 1 to September 31

RELATED POSTS

+ Success tips when doing bussiness in vietnam

+ Interesting facts about Vietnam

+ Client case studies

FREE CONSULTATION, NO OBLIGATION. YOU ASK, WE ANSWER!

Việt Nam

Việt Nam Chinese

Chinese

.png)

.jpg)